Mastering PrimeXBT Risk Management for Successful Trading

In the world of trading, whether it be cryptocurrencies, forex, or commodities, risk management is paramount. With volatile markets and the potential for substantial financial loss, understanding and implementing a solid risk management strategy is critical. This article explores essential risk management strategies that every trader should know, particularly focusing on the platform PrimeXBT Risk Management PrimeXBT Risk Management.

Understanding Risk Management

Risk management in trading involves the identification, analysis, and mitigation of risks that can affect a trader’s financial performance. It is about protecting your capital while still allowing for growth and profit generation. Without a robust risk management strategy, even the most successful traders can quickly find themselves at a financial dead end.

The Importance of Risk Management in Trading

The volatility of the financial markets is a double-edged sword. On the one hand, it provides opportunities for profit; on the other hand, it poses significant risks. Mismanaging risk can lead to devastating losses, which can wipe out a trader’s account entirely. Effective risk management not only preserves your capital but also provides the emotional stability necessary for making sound trading decisions.

Key Risk Management Strategies

1. Position Sizing

Position sizing is a fundamental component of risk management on PrimeXBT. It involves determining the amount of capital to allocate for each trade based on your total capital and the level of risk you are willing to take. A common rule of thumb is to risk no more than 1-2% of your trading capital on a single trade. This strategy ensures that a series of losses won’t significantly deplete your capital, allowing you to continue trading in the long run.

2. Stop-Loss Orders

Implementing stop-loss orders is another essential element of risk management. A stop-loss order automatically closes a trade at a predetermined price level, thus limiting potential losses. By defining your risk upfront, you can maintain discipline and avoid emotional decisions during periods of market volatility. On PrimeXBT, setting stop-loss orders is straightforward, making it easy for traders to protect their investments.

3. Diversification

Diversification involves spreading your investments across various assets to reduce risk exposure. Instead of putting all your capital into a single asset, consider investing in a mix of cryptocurrencies, forex pairs, and commodities available on PrimeXBT. This strategy can help mitigate the impact of a poor-performing asset on your overall portfolio.

4. Risk-Reward Ratio

Establishing an effective risk-reward ratio is crucial for ensuring that potential profits justify the risks taken. A common approach is to aim for a risk-reward ratio of at least 1:2, meaning that for every $1 risked, there is a potential to gain $2. By analyzing trade setups through this lens, traders can make more informed decisions about entering and exiting trades.

5. Regular Review and Adjustment

Successful traders regularly review their trading strategies and adjust their risk management practices accordingly. Analyze past trades to identify patterns in your performance. Are you consistently losing money on certain trades? Are there specific market conditions that lead to losses? By answering these questions, you can refine your approach and improve your risk management on PrimeXBT.

Emotional Discipline in Trading

Risk management is not just about setting rules; it’s also about managing emotions. Fear and greed can lead to impulsive decision-making that undermines a trader’s strategy. Having a clear risk management framework helps keep emotions in check, enabling you to stick to your trading plan. Remember that losses are part of trading; accepting this reality can foster a more disciplined approach.

Utilizing PrimeXBT Tools for Risk Management

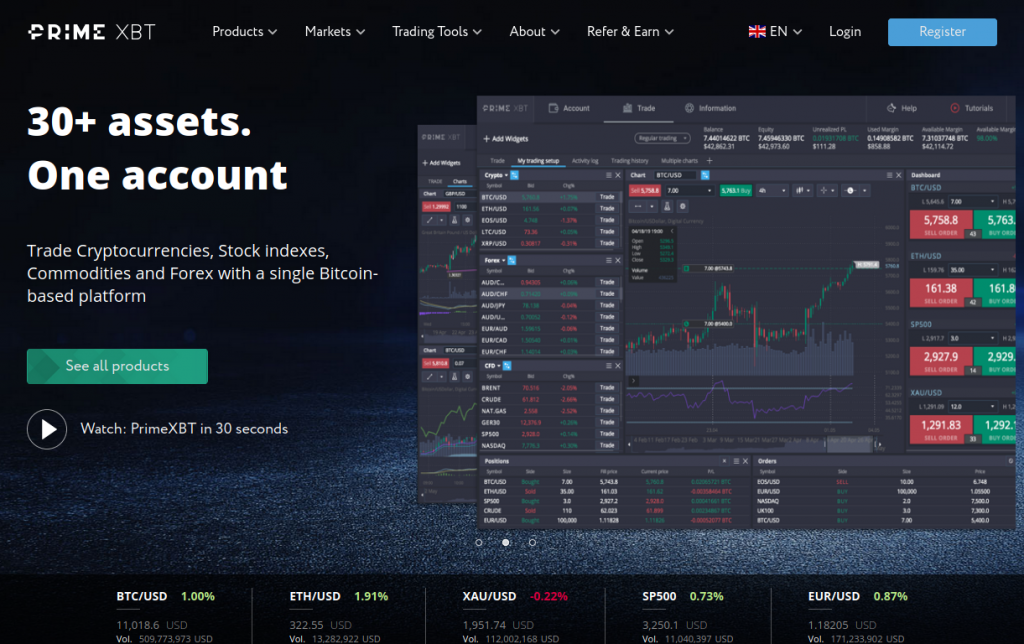

PrimeXBT offers various tools designed to assist traders in managing risk effectively. Features such as stop-loss orders, take-profit levels, and margin trading allow traders to customize their trading experience according to their risk tolerance. Additionally, PrimeXBT’s user-friendly interface makes it easy to track trades and adjust positions as necessary.

Conclusion

In conclusion, effective risk management is a non-negotiable aspect of trading successfully on PrimeXBT or any trading platform. By implementing strategies such as position sizing, stop-loss orders, diversification, and maintaining a healthy risk-reward ratio, traders can significantly increase their chances of long-term success. Remember to stay disciplined emotionally and continuously review and adjust your strategies to align with market conditions. By mastering PrimeXBT risk management, you pave the way for sustainable and profitable trading.